Are you a Canadian business owner looking to scale up? The Canada Digital Adoption Program (CDAP) might just be the golden ticket you need.

With up to $100,000 in funding through a zero-interest loan, the CDAP loan is a unique opportunity for small and medium-sized enterprises (SMEs) in Canada to grow their business. Let’s dive into how you can get your hands on this funding and give your business the digital boost it deserves.

What is a CDAP Loan?

The CDAP loan is part of the Canadian government’s initiative to encourage digital transformation among SMEs. What makes this loan stand out is its zero-interest feature, making it an extremely attractive option for businesses looking to adopt digital technologies without the burden of heavy interest payments.

Step1: Understanding Business Loans

When it comes to business loans, the CDAP loan stands out for its unique advantages:

- Zero Interest Loan: The most significant benefit of the CDAP loan is its zero-interest feature, making it a financially attractive option for digital growth. The zero-interest aspect of the CDAP loan is what sets it apart from other financing options. It allows businesses to invest in digital growth without the worry of accruing interest, providing a rare financial relief in the business world.

- Tailored for SMEs: Designed specifically to cater to the needs of Canadian SMEs, this loan addresses the challenges and opportunities unique to this segment.

Step 2: CDAP Loan Eligibility: Is Your Business Qualified?

Before setting your sights on this opportunity, let’s talk about who can benefit from this program. Here are the key criteria for CDAP loan eligibility:

- Business Type: Your venture must be a for-profit entity, incorporated in Canada.

- Operational Tenure: Minimum of two operational years.

- Employee Strength: Between 1 and 499 full-time equivalent employees.

- Revenue Parameters: Annual gross revenue between $500,000 and $100 million.

Step 3: The CDAP Registration Process

Your CDAP application journey starts with registration. Here’s how to get started:

- Begin with Registration: Initiate your journey by registering for the CDAP program. This step is crucial as it involves a Digital Needs Assessment, which evaluates your business’s current digital maturity.

- Create a Digital Adoption Plan: Partner with a registered CDAP Digital Advisor to craft a plan that outlines your digital adoption strategy.

Step 4: The CDAP Loan Application

Detailed Guidance for Loan Application Submission:

- Prepare Comprehensive Documentation: Ensure you have all the necessary documents ready. This includes your business registration details, financial statements, and a detailed digital adoption plan.

- Understand the Business Development Bank of Canada (BDC) Process: Familiarize yourself with the BDC’s application process. Check their website for any updates or specific requirements.

- Present a Strong Case: Your application should clearly articulate how the digital adoption plan will enhance your business’s efficiency, competitiveness, and revenue.

Additional Tips for Success

- Start Early: The CDAP funding application process is competitive; begin your preparation in advance.

- Seek Professional Help: Engage with a CDAP advisor or consultant to strengthen your application.

- Network and Connect: Participate in CDAP workshops and events for insights and networking

Step 5: Implementing Your Digital Plan

Effective Execution of the Digital Adoption Plan

- Project Management: Assign a dedicated team or individual to oversee the implementation of the digital plan. Regular check-ins and project updates are essential.

- Leverage Technology and Partnerships: Utilize the latest digital tools and technologies. Partner with tech providers or digital consultants for expert guidance.

Monitoring Progress and Reporting

- Set Key Performance Indicators (KPIs): Establish clear metrics to measure the success of your digital initiatives.

- Regular Reporting to CDAP: Maintain a schedule of regular updates and reports to the CDAP. This should include progress on KPIs, challenges faced, and milestones achieved.

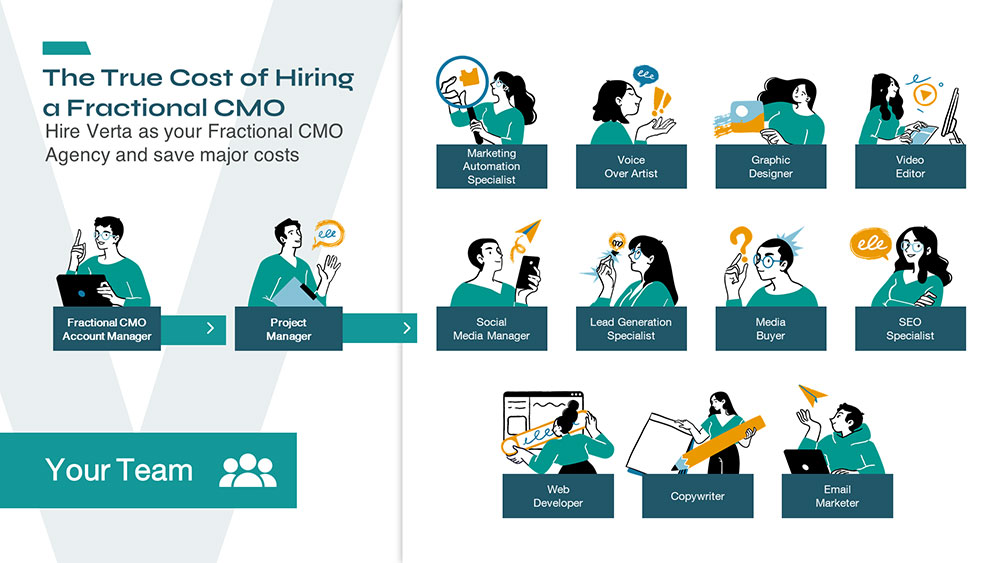

Make the Most of the CDAP Loan – Apply with Verta Marketing Inc.

The CDAP loan is more than just funding; it’s a stepping stone to digital empowerment for Canadian SMEs. With zero interest and a substantial funding amount, it’s an opportunity worth exploring. Ready to take the leap? Let Verta Marketing be your partner in this transformative journey.

Remember, the digital world is vast, and with the right resources, your business can soar to new heights.

At Verta Marketing, we believe in making your business dreams a reality. While we can’t apply for the loan on your behalf, we’re here to guide you through every step – from understanding your eligibility to crafting a compelling digital adoption plan. So, why wait? Explore how the CDAP loan can redefine the future of your business today.